Mumbai, October 01, 2022: Knight Frank – NAREDCO Report on ‘The Grand Revival of Mumbai’s Residential Market’ cited that despite headwinds,Mumbai Metropolitan Region’s residential demand continues to grow in 2022. In just 9 months of the year 2022, the city has achieved sales volume of 65,650 home units which is 8% higher than the annual pre-pandemic levels of 60,943 units recorded in 2019. This velocity has been achieved in a year marked by 140 bps repo rate hike (until 29th September 2022), levy of additional 1% metro cess and no stamp duty cut benefits.

Residential Sales Growth 2019-2022

| Year | Sales (No. of Units) | Growth with reference to pre-pandemic level |

| 2019 (pre-pandemic level) | 60,943 | |

| 2020 | 48,688 | -20% |

| 2021 | 62,989 | 3% |

| 2022 YTD (January-September, 2022) | 65,650 | 8% |

Source: Knight Frank Research

INR 10 mn and above ticket size gaining traction in 2022

The share of housing sales for properties with ticket sizes in the range of INR 10-20 mn rose from 16% in 2021 to 18% in 2022 YTD, while premium housing gained traction with the share of above INR 20 mn ticket size growing from 6% in 2021 to 10% in 2022 YTD. This reflects the home buyer’s inclination towards purchasing large sized homes. The demand for homes with ticket sizes ranging from INR 5-10 mn however, has shrunk from 30% market share in 2021 to 22% in 2022 YTD.

The demand for residential properties with ticket size of INR 2.5-5 mn remained unchanged over the year with a share of 29%. Under INR 2.5 mn ticket size properties saw a minor upward movement amounting to 20% of the total annual sales.

Size Split for Sales in 2021 and 2022*

| Price Ticket Categories | 2021 | 2022 YTD* | ||

| Sales Volume | % share | Sales Volume | % share | |

| <2.5 mn | 11,986 | 19% | 13,000 | 20% |

| 2.5–5 mn | 18,013 | 29% | 19,249 | 29% |

| 5-7.5 mn | 9,613 | 15% | 8,692 | 13% |

| 7.5-10 mn | 9,433 | 15% | 6,041 | 9% |

| 10-20 mn | 10,040 | 16% | 12,007 | 18% |

| >20 mn | 3,905 | 6% | 6,661 | 10% |

Source: Knight Frank Research

*Note: 2022 (YTD) data updated until Q3 2022.

From the perspective of Q3 2022, the report highlighted that demand for homes with INR 10 mn and above ticket size recorded an uptick. INR 10-20 mn category recorded a share take-up of 19% as compared to 18% in Q2 2022, while the above 20 mn ticket size category recorded a share take up of 11% as compared to 10% in Q2 2022. The demand for 5-10 mn category remained unchanged. MMR recorded a dip in demand for homes in under INR 5 mn categoryto a share contribution of 47%.

Size Split for Sales in Q2 2022 and Q3 2022

| Price Ticket Categories | Q2 2022 | Q3 2022 | ||

| Sales Volume | % share | Sales Volume | % share | |

| <2.5 mn | 4,601 | 20% | 4,088 | 19% |

| 2.5–5 mn | 6,894 | 30% | 6,109 | 28% |

| 5-7.5 mn | 2,836 | 13% | 2,827 | 13% |

| 7.5-10 mn | 2,136 | 9% | 1,988 | 9% |

| 10-20 mn | 3,972 | 18% | 4,155 | 19% |

| >20 mn | 2,212 | 10% | 2,282 | 11% |

Source: Knight Frank Research

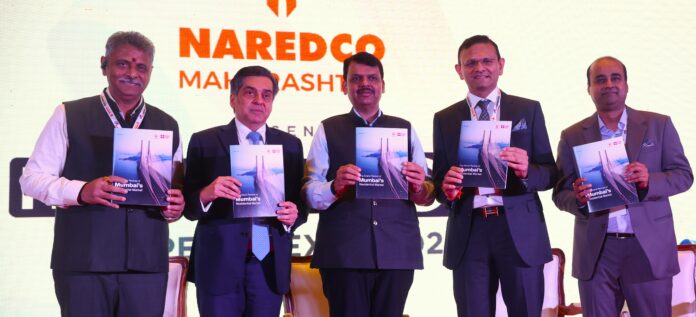

At the launch of the Knight Frank – NAREDCO report ‘The Grand Revival of Mumbai’s Residential Market’, Shishir Baijal, Chairman & Managing Director, Knight Frank India said, “The MMR residential market is a story of sustained growth over the last eight quarters. This sales momentum has been the result of a combination of factors such as – attractive pricing, lowest home loan interest rates and State Government stimulus, all ensuring that home affordability is in an attractive zone for buyers. However, the biggest change has been the buyer’s perception which is positively tilted towards home ownership. We expect the core strength of the market to remain intact in the future, despite the headwinds created by the geo-political situation and their economic impacts, albeit the factors of affordability are not breached abruptly and are in tandem with growth in income.”

Supportive of housing demand, supply of homes in the ticket size of INR 10-20 mn grew substantially from 14% in 2021 to 22% in 2022 YTD. The premium category houses also recorded a rise in supply with its contribution from 7% of the total launches to 11%. INR 7.5-10 mn ticket size contracted its share of launches from 18% in 2021 to 11% in 2022 YTD.

From the perspective of Q3 2022, the report highlighted that the supply of housing having ticket sizes ranging from INR 2.5-5 mn recorded the largest share take up of 33%, followed by ticket sizes ranging from INR 10-20 mn having a share take up of 32%.

Residential value surges by 6% YoY in Q3 2022; Weighted Average Price recorded at INR 7170 per sq ft.

Changing global scenario leading to a rise in raw material prices coupled with the robust sales momentum encouraged developers to opt for price rise in 2022. The weighted average price in MMR is reported to be INR 7170 sq ft.

Sharing the context to the price movement since 2010, the report cited that weighted average prices in MMR recorded an upward movement since 2010 and peaked in 2016, recording an average housing price of INR 8120 per sq ft. The rise is in tandem with the fall in housing sales between 2010 and 2016. The highest YoY growth in the weighted average housing prices was recorded at 10% in 2014. Post 2017, the housing prices started to ease in the MMR region. The timeline coincided with the implementation of RERA and GST. Turnaround was witnessed in 2020 where the housing sales picked up on account of stamp duty waiver and all-time low mortgage rates and the price value has been moving into higher trajectory since then.

Central suburbs emerged as a preferred market in 2022;

Central suburbs are the only market that recorded a substantial YoY growth in 2022 YTD of 33%.

Peripheral central and western suburbs continue to remain the preferred location for homebuyers in Q3 2022

Housing demand in Q3 2022was mainly concentrated in the peripheral suburban micro markets. Peripheral central suburbs account for 22% of the housing demand in Q3 2022, followed by peripheral western suburbs accounting for 18%.

Commenting on the occasion, Mr. Sandeep Runwal- President NAREDCO Maharashtra and MD Runwal Developers, said, “The Mumbai Metropolitan Region, which is constantly changing, has seen the most rapid growth in the real estate sector and has seen a lot of change in the recent years, and we, at NAREDCO Maharashtra have always been at the forefront of proactive sector assessment and have worked closely with government bodies to ensure that the ‘Housing For All Initiative, which aims to promote affordable housing in the country, is carried out with the formation of new units across the state.”

“NAREDCO Maharashtra has addressed and discussed a variety of real estate-related issues, including infrastructure development and construction material costs,”he added.

THE BIG INFRASTRUCTURE PUSH – MMR

International property consultant Knight Frank India along with NAREDCO today highlighted “THE BIG INFRASTRUCTURE PUSH”. Itassesses the real estate impact of the massive INR 2.1 trillion of transport infrastructure projects currently underway in the Mumbai Metropolitan Region (MMR) excluding Navi Mumbai International Airport. The report analyses their impact in terms of the locations/ corridors that are likely to see the most traction in terms of real estate development due to the improved connectivity.

The report has identified 20 locations as the next real estate growth corridors in MMR as a direct outcome of the infrastructure development. Primarily the result of approximately 250 km of Metro lines and 70 km of road projects cumulatively worth over Rs 2.1 trillion (INR 2.1 lakh crore) at various stages of construction in the region. The extent of real estate traction in the resulting locations has been evaluated based on the availability of land for greenfield development or the redevelopment potential that the catchment offers.

KEY INFRASTRUCTURE PROJECT IMPACT ON REAL ESTATE

| METRO LINE NAME | PROJECT IMPACT ON REAL ESTATE SUPPLY |

| Mumbai Metro Line 2 ADahisar to DN Nagar | Estimated 11 mnsq ft of office space to be added |

| Mumbai Metro Line 3Colaba – Bandra – SEEPZ | Estimated 2.8 mnsq ft of office space to be added in BKC |

| Mumbai Metro Line 4Kasarvadavali (Thane) to Wadala

And Mumbai Metro Line 4 A Kasarvadavali to Gaimukh |

Estimated 50 mnsq ft of real estate supply to be added |

| Mumbai Metro Line 6Lokhandwala to Vikhroli (EEH) | Office space development of 32 mnsq ft, adding approximately 20% to the existing stock of Mumbai |

| Mumbai Metro Line 7Dahisar East to Andheri East | Estimated 30 mnsq ft of office space or a massive 20% to the existing inventory |

| Chattrapati Shivaji Maharaj Terminals (CSTM) Redevelopment | Up to 1.8 mnsq ft of commercial development or 1 mnsq ft of residential development could be taken up at Byculla as a result of the redevelopment exercise |