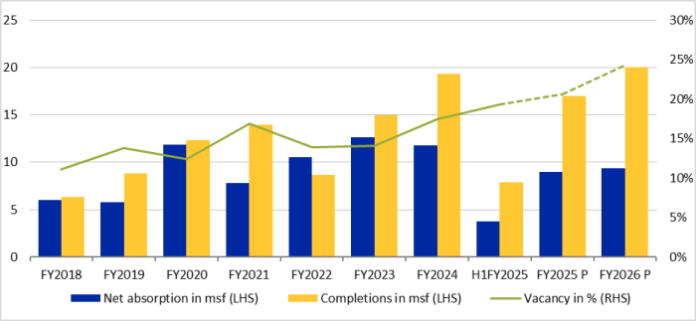

· Vacancy levels for Hyderabad office market to increase significantly by ~1000 bps to 24-24.5% by March 2026 from 14.1% as of March 2023

· Hyderabad office market staring at lowest occupancies among top 6 cities in India by Mar-2026

New Delhi, January 13, 2025: ICRA estimates the occupancy in the Hyderabad market to compress to around 75.5-76.0% for Grade A office space by March 2026 from ~86.0% as of March 2023 as supply is expected to significantly outpace net absorption. Office supply grew at a higher CAGR of ~14% during FY2017 – FY2024 for the Hyderabad market, compared to a CAGR of ~7% for the top six office markets[1] in India. Hyderabad accounts for around 15% of total available office supply from the top six markets as on March 31, 2024, which ICRA expects would rise to 17% by March 2026.

Giving more insights, Anupama Reddy, Vice President and Co-Group Head, Corporate Ratings, ICRA, said: “Hyderabad is the only prominent major Indian city that has an unlimited FSI[2] rule. Taking advantage of such norms, some developers are undertaking large speculative construction (without near-term visibility on tenant leasing), resulting in a huge demand-supply mismatch. Hyderabad witnessed an all-time high supply of ~19 msf in FY2024, the highest in its history and the largest yearly addition in India across locations. This high supply trend is expected to continue through FY2025 and FY2026 with estimated new supply of 17-20 msf each year. However, net absorption is expected remain in the range of 9-12 msf each year, resulting in a steep increase in vacancy levels to 24-24.5% by March 2026 from 14.1% as of March 2023 (19.3% as of September 2024). ICRA estimates the city to have the highest vacancy levels by March 2026 among India’s top six cities, surpassing Delhi NCR.“

EXHIBIT 1: TRENDS IN SUPPLY, ABSORPTION AND VACANCY FOR HYDERABAD OFFICE MARKET

The North-west Region in Hyderabad accounts for 88-89% of total grade-A office space as on September 30, 2024. Hitech City, Gachibowli and Financial District are the top three micro-markets, which account for 70% of the total office supply. The vacancy levels are expected to remain Stable in Hitech City (9.5-10.0%) as it remains the preferred office location for tenants due to good transport connectivity. However, vacancy levels are expected to shoot up significantly to 25-30% for Gachibowli and Financial District by March 2026 as 60% of the upcoming supply in FY2026 is getting added in these two micro markets, resulting in supply outpacing net absorption. The top three segments, which continue to drive demand in Hyderabad, are IT – Business Process Management (BPM), Banking, Financial Services and Insurance (BFSI) and flexible workspaces.

“The current over-supply market conditions could turn out to be favourable for the new tenants. For the existing leased spaces, the rentals are expected to rise steadily due to contracted rental escalations. However, for new leasing, the landlords are expected to remain flexible by offering extended rent-free period and consequently, the effective rent rate would be at a discount to the prevailing market rates or new deals may happen at lower rates compared to current average rentals in these micro markets. For some of the developers, this will have a bearing on the return metrics and debt-raising potential for the upcoming projects, where occupancy is expected to be low,“ Reddy added.

Corporate Comm India (CCI Newswire)