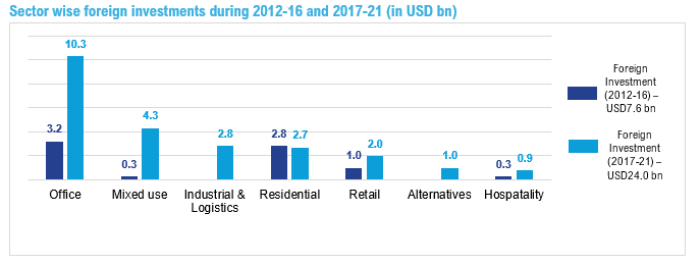

Foreign capital flows into real estate jumped 3x to USD24 bn post reforms

- Foreign investments into office asset class have consistently mopped up at least USD2.0 bn annually since 2017 except 2021

- Industrial and logistics emerged as the most preferred asset class by foreign investors in 2021, amassing one-third of foreign investments at USD 1.1 bn, surpassing the office sector

- The share of investments from the USA and Canada together has been more than 60% in foreign investments in each of the years since 2017, targeted mainly towards office and industrial asset class

- During 2021, the residential asset class saw a rebound in investments after a lull for two years

Gurugram, March 05, 2022: During 2017-21, the foreign capital flows in real estate jumped 3X times to USD24.0 bn compared to the preceding five-year period, as per Colliers report “Foreign investments in Indian real estate turn a corner” released in association with FICCI. Over the last five years, global investors have shown an increased inclination towards investment in Indian real estate buoyed by regulatory reforms introduced in 2016.

Foreign investors, who had previously refrained from investing in the Indian real estate market due to the lack of transparency, started investing in the country with greater optimism from 2017. The share of foreign investments in Indian real estate has grown to 82% during 2017-2021, compared to 37% in the preceding five-year period.

Piyush Gupta, Managing Director, Capital Markets and Investment Services, Colliers India, added, “We are witnessing a buoyancy in Global capital inflows in India across asset classes, with office and industrial assets remaining the most preferred. The investors take a long-term view with significant exposure on development assets, reflecting confidence to take construction risks with credible Partners. The investors continue to invest with developers with proven expertise in respective business areas to build and acquire long-term sustainable assets. With residential sales continuing to do well across markets in India and available opportunities to grow for developers, more structured Capital is likely to flow into the sector”.

Office Sector dominant post 2016; Industrial and Logistics leads in 2021

During 2017-21, the Office sector holds the frontline of foreign investments with 43% share in total foreign investments followed by mixed-use sector accounting for 18% share in total foreign investments. The investments in the Industrial and Logistics sector stand at position three surpassing the residential sector. Foreign investors remained cautious about the residential sector in the aftermath of the NBFC crisis and subdued residential sales. The share of residential assets in total foreign investments has reduced to 11% in 2017-2021, from 37% in a preceding five-year period.

“Demand for alternative assets including life science labs, data centres, flex spaces has grown during the pandemic as investors seek new avenues for growth and returns. Data centres garnered a maximum share of 52% of foreign investments in alternatives in last five years. Lack of income producing data centre assets in key locations and scope for future REIT listings will push investors to form new platforms for development opportunities. In the past five years, capital commitments equating USD13.5 bn have been made by global data center operators, corporates, and investors for the development of data centers in India”, says Vimal Nadar, Senior Director, Research, Colliers India.

Office sector grows 3X to USD10.3 bn in 2017-2021

Office sector saw a significant uptick in foreign capital flows post regulatory reforms in 2016, like enhanced transparency, robust demand for Grade A office space and exit avenues like REITs bolstered investments. Foreign investments in the office sector have consistently reached USD2.0 bn in each year since 2017 except in 2021, where the quantum of investments almost halved.

The Industrial and Logistics sector emerges as the top gainer in 2021

Momentum in Industrial and logistics assets in India has picked up only in the last five years driven by robust demand from E-commerce and 3PL firms for modern warehousing facilities. In 2021, Industrial and logistics assets emerged as the top choice for foreign institutional investors, garnering almost a third of foreign investments (USD1.1 bn) surpassing the office sector. Lack of ready Grade A industrial and logistics parks across tier I and II locations amid high demand scenario has pushed investors to create platforms for the development of modern warehousing facilities in these locations.

Alternative assets seeing strong investor interest

During 2017-21, alternative assets saw an inflow of about USD1 bn, with a majority of it coming during the pandemic years. Government policy for data localisation and infrastructure status received for data centres recently are likely to give a boost to the establishment of new data centres in the country.

Canada and USA dominant investors

The share of investments from the USA and Canada together has been more than 60% in foreign investments each of the years since 2017. Despite the challenges posed by the pandemic, the funds from USA and Canada continue to actively explore the industrial segment, apart from the office and mixed-use assets. Similarly, the majority of the investments from Asia are targeted towards the office and industrial and logistics sector.

Corporate Comm India (CCI Newswire)

Recent Posts

Danube Properties Unveils ‘Sparklz by Danube’ at IPS 2025 – A Dazzling New Residential Gem in the Heart of Al Furjan

New Delhi, April 28, 2025: Danube Properties, one of the UAE's leading private real estate developers,…

Vicky Kaushal Renews Lease for Luxury Apartment Taken on Rent in Mumbai’s Juhu, Set to Pay Rs. 6.2 Crore in Three Years: Square Yards

New Delhi, April 28, 2025: Bollywood actor Vicky Kaushal has renewed his lease for an…

Experion Developers unveils ‘The Trillion’, Gurugram’s latest luxury landmark

The luxury residential project located in Sector 48 features three iconic and ultra-luxury 45-floor towers…

Omaxe Group’s “Splash n Play,” the Ultimate Water Experience, created a splash in New Chandigarh

New Delhi, April 28, 2025: Over the duration of a memorable weekend on April 26…

Casagrand Continues its Aggressive Expansion in Hyderabad; Launches Its Fourth Project – Casagrand GS Infinity in Attapur

A landmark in ultra-luxury living, Casagrand GS Infinity offers 405 exquisitely designed 3 & 4…

Gold, Cashback & Cheer: Festive Deals to drive homebuying surge this Akshaya Tritiya

New Delhi, April 26, 2025: Mumbai's real estate market is poised for a significant upswing,…